Alphabet Stock (NASDAQ:GOOGL) Is Now My Largest Tech Holding. Here’s Why

Alphabet stock (NASDAQ:GOOGL) (NASDAQ:GOOG) is now my largest tech holding, making up about 8% of my portfolio. Lately, I have added multiple times to my position, as Alphabet’s Q4 results showed strong revenue growth, expanding margins, surging profits, and increasing capital returns. Further, even though Alphabet retains double-digit top and bottom-line growth prospects, the stock appears cheap both independently and compared to the Magnificent Seven stocks. Thus, I remain bullish on the stock.

Q4 Results Reinforced My Conviction in the Stock

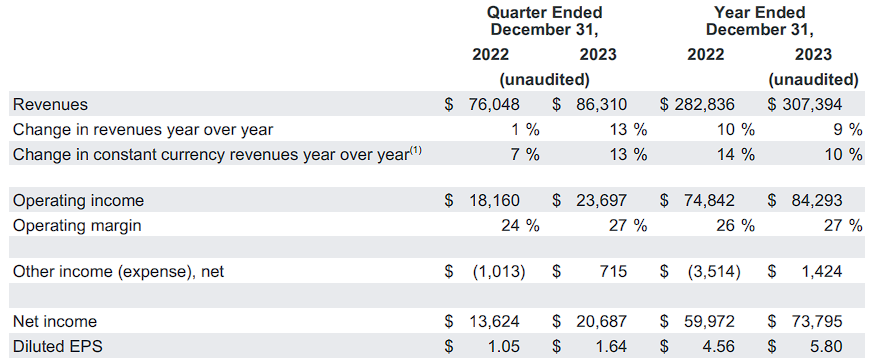

I have recently increased my Alphabet position multiple times, with its Q4 results further reinforcing my conviction in the stock’s bull case. To begin with, Alphabet posted reaccelerating revenue growth of 13% to $83.6 billion — a notable uptick from the previous quarter’s 11% and last year’s 1%.

Furthermore, EPS surged 56% to $1.64, as the bottom line was also boosted by an expansion in Alphabet’s operating margin from 24% to 27%. Notably, Q4’s revenues and EPS beat prior consensus estimates by 1.2% and 2.5%, respectively, surpassing market expectations. Let’s take a closer look.

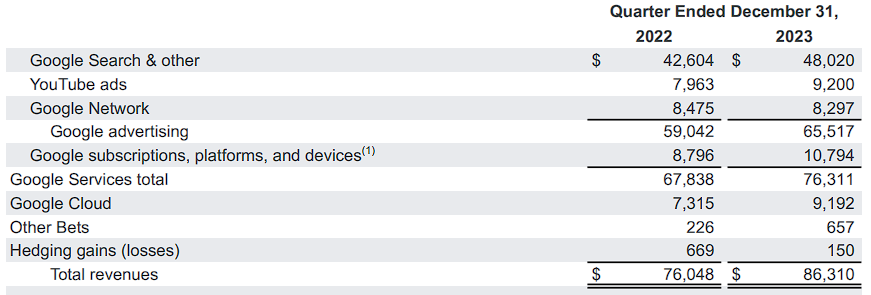

Google, YouTube Drive Strong Advertising Momentum Backed by AI

Strength in Google and YouTube were the primary drivers of Alphabet’s revenue growth in Q4. Google Search revenues surged 13% to $48 billion, while YouTube advertising revenues grew by an even more significant 16% to $9.2 billion. The results benefited from an improving advertising environment, particularly in retail, and, interestingly, from Google’s investments in AI over the past year.

During the Q4 earnings call, Sundar Pichai, Google’s CEO, underscored the transformative impact of AI on the company’s growth across various platforms. Pichai emphasized the critical role of generative AI in improving Search. By utilizing generative AI, Search has addressed a broader spectrum of information needs and responded to novel queries with diverse perspectives. This, in turn, has significantly bolstered ad performance metrics for advertisers.

Then, on YouTube, the company continues to reap the rewards of prioritizing a creator-first economy within its platform. By offering creators unparalleled opportunities to monetize their content and establish their own businesses, YouTube has become the preferred growth channel for many creators. This has led to an influx of content, which, in turn, has led to increased viewership and, thus, growing ad revenue.

Once more, the power of AI, specifically Google’s generative AI, is pushing these capabilities to extraordinary levels. Think about this: with just a smartphone, anyone can effortlessly change their backdrop, eliminate unnecessary elements from the background, and easily translate their videos into numerous languages without a big studio budget. The success of these initiatives is evident in YouTube’s staggering numbers, with Shorts now boasting over two billion logged-in users per month and 70 billion daily views.

Google Cloud: Profits Are Snowballing

Alphabet’s Google Cloud division also posted impressive numbers, with the main highlight, for me, being its snowballing profits. Google Cloud’s unit economics continued to improve, with Q4 being the division’s fourth consecutive profitable quarter. Specifically, Google Cloud revenue growth came in at an impressive 26%, accelerating from Q3’s revenue growth of 22%, driving robust economies of scale. Consequently, the division’s operating margin surged to 9.4%. The year before, it was negative.

With Duet AI, Google Cloud’s AI-powered collaborator, the company now empowers top-tier brands such as PayPal (NASDAQ:PYPL) and Deutsche Bank (NYSE:DB) to supercharge developer productivity. At the same time, AI capabilities offered in the Cloud facilitate retailers like Aritzia (OTC:ATZAF) and Gymshark to understand their customers by breaking down priceless insights. As Alphabet utilizes Google Cloud to cater to each customer’s needs, I believe its momentum is set to continue for many quarters.

Record EPS & Capital Returns, Yet the Stock Remains Cheap

Alphabet’s strong revenue growth and margin expansion across the board led to the company posting record quarterly EPS of $1.66 for Q4 and a record annual EPS of $5.84 for FY2023. In turn, the company was able to afford increased capital returns to reward shareholders, with share repurchases for the year reaching a record $61.5 billion, up from $59.3 billion last year.

At its current market cap, this implies a buyback yield of 3.5%, which I find rather substantial given that Alphabet is expected to keep growing in the double digits. Specifically, consensus estimates for FY2024 point toward revenues of $342.41 billion and EPS of $6.76, suggesting year-over-year growth of 11.4% and 16.6%,…

Read More: Alphabet Stock (NASDAQ:GOOGL) Is Now My Largest Tech Holding. Here’s Why