The race to reinvent the space station

At the end of August a parcel arrived from outer space for a small Connecticut-based biotech company called LambdaVision. Inside the shoebox-sized package were samples of a protein-based film that the company hopes will one day be the basis of an artificial retina to restore sight to people blinded by age or genetic disease.

The film was created some 420km above Earth, on the International Space Station, where the microgravity environment allows LambdaVision to produce more consistent and even layers of proteins. The retinas are still under development, but Nicole Wagner, LambdaVision’s chief executive, believes that in a few years the company could produce them at scale on commercial space stations.

“There’s a lot of promise in continuing to do this work in a microgravity environment,” she says. “But the ISS is a research lab. Commercial space stations will have more capabilities. They will be designed with the future in mind.”

The race to outline that future is already under way. American companies including Jeff Bezos’s Blue Origin, Sierra Space, Northrop Grumman, Axiom Space, Lockheed Martin and Nanoracks have been spurred by a Nasa-funded competition to design privately owned replacements for the ISS when it is decommissioned by the end of the decade.

Four initial contracts have already been awarded and the winner, or winners, to be selected by Nasa in around 2025, could expect an estimated $1bn in annual revenues from the American agency to deliver space station services.

But the contenders are hoping for an even bigger prize: to become the go-to platform for a rapidly emerging space economy spanning research, manufacturing, tourism, entertainment and more.

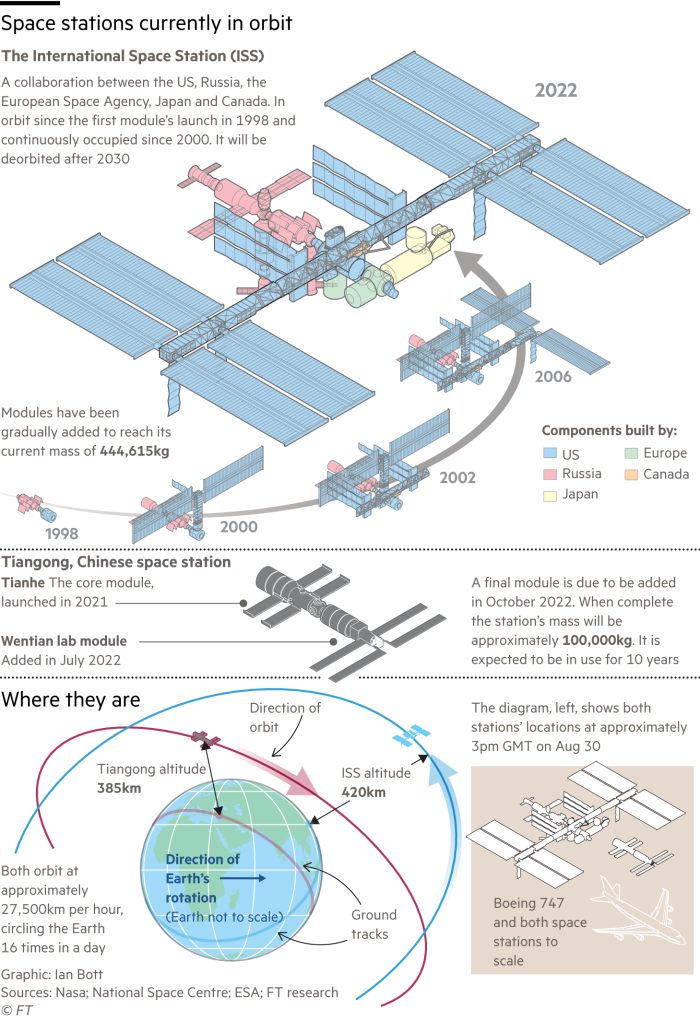

The ISS has been the trailblazer, the greatest global collaboration in the history of technology. During 22 years of continuous habitation it has hosted 258 astronauts and cosmonauts from 20 countries and thousands of groundbreaking experiments. “Research conducted aboard [the] ISS . . . has spanned every major scientific discipline,” according to a transition report prepared for US Congress earlier this year by Nasa.

Work on the space station has helped the development of drugs for cancer, Alzheimer’s and Duchenne muscular dystrophy. Even household goods such as fabric softener have been enhanced thanks to space-based research, leading to three patents registered by consumer goods company Procter & Gamble.

While the space station is now nearing the end of its life, back on Earth, cost considerations and geopolitical tensions are making it harder to sustain the remarkable international collaboration between five space agencies (those of the US, Russia, EU, Canada and Japan) that has kept it aloft for far longer than intended.

The ISS has cost more than $159bn over its lifetime and some $3bn a year to operate, roughly one-third of Nasa’s annual budget for human space flight. Transitioning to commercial platforms could free up some $1.8bn a year by 2033, according to the Nasa report — funds that could be used for a new age of space exploration.

“As larger government agencies focus on the bigger goal of going back to the moon and creating a sustained presence there — and then on to Mars — they hope to save time and money by having commercial providers help maintain a presence in low Earth orbit,” says Dhara Patel of the UK National Space Centre.

Fraying partnerships

The ISS has been the most visible example of a successful working partnership between Moscow and the west in the space domain. But Russia’s invasion of Ukraine this year has pushed that relationship to breaking point. In July, Yuri Borisov, the new head of Russia’s space agency, Roscosmos, repeated the country’s threat to quit the station “after 2024”.

Not everyone believes Russia will leave. The country has voiced ambitions to build its own space station, which would “take five, six or seven years minimum,” says David Parker, director of human and robotic exploration at ESA, the European Space Agency. “The Russians don’t want their cosmonauts kicking their heels . . . so it’s important for them to maintain operational capacity on the ISS.”

But the repeated threat of Russia’s early exit has intensified pressure on ISS partners to find a way to maintain continuous human presence in orbit. Not only is there still research to be completed to fulfil the ambition of major agencies such as Nasa and Europe’s ESA to go to the moon and Mars. Access to space is also being seen as a question of national competitiveness and security.

“We don’t want to have a gap in Leo [low Earth orbit],” says Robyn Gatens, ISS director at Nasa. “We want to transition all our users whether government, commercial or university seamlessly.”

Western governments are keenly aware that China is about to complete its own space station, Tiangong, and is opening it up to companies and allies. “It is imperative for the US government that none of its allies or friends are only able to access space through China’s space station,” says one executive who has discussed the issue with both Nasa and the US Department of Defense.

Three years ago Nasa began preparations for the transition by loosening restrictions on commercial activity in the ISS. ESA too is making a notable shift towards the commercial use of space.

Greater access and the falling costs of launching into space are fuelling demand for the ISS. “We have a very busy programme of scientific activities,” says Parker. “We have a substantial idea of what we’ll be doing for the next six or seven years and we’re starting to think about how the scientific infrastructure might be used on other platforms.”

Rather than bearing the cost of a single, huge successor station, the strategy led by Nasa has been to promote a small number of privately owned and operated platforms. It expects them to be operating by 2028, giving users two years to transition before the ISS is decommissioned in 2030.

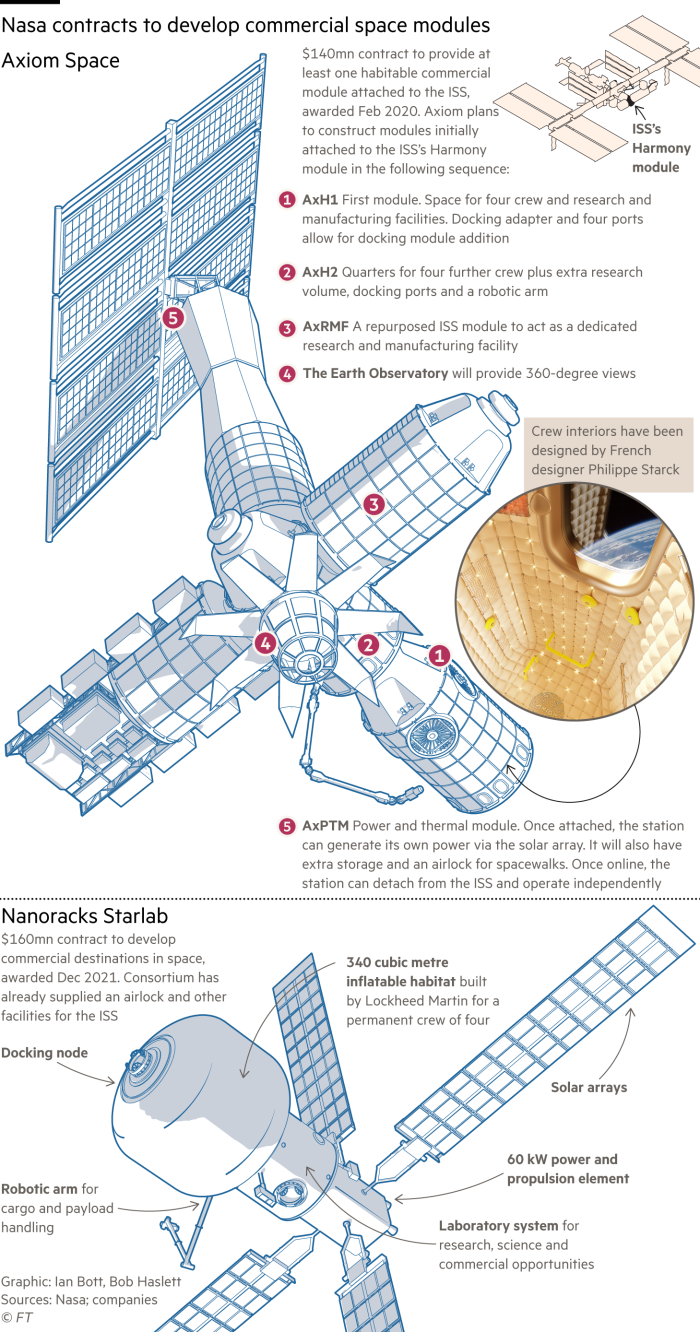

The agency has already allocated $550mn for the development of four different models. In 2020, Houston-based Axiom Space won a competition to attach a module to the ISS, which will be gradually expanded until it finally detaches into independent orbit when the station is decommissioned. It aims to host a variety of activities from research to tourism and astronaut training.

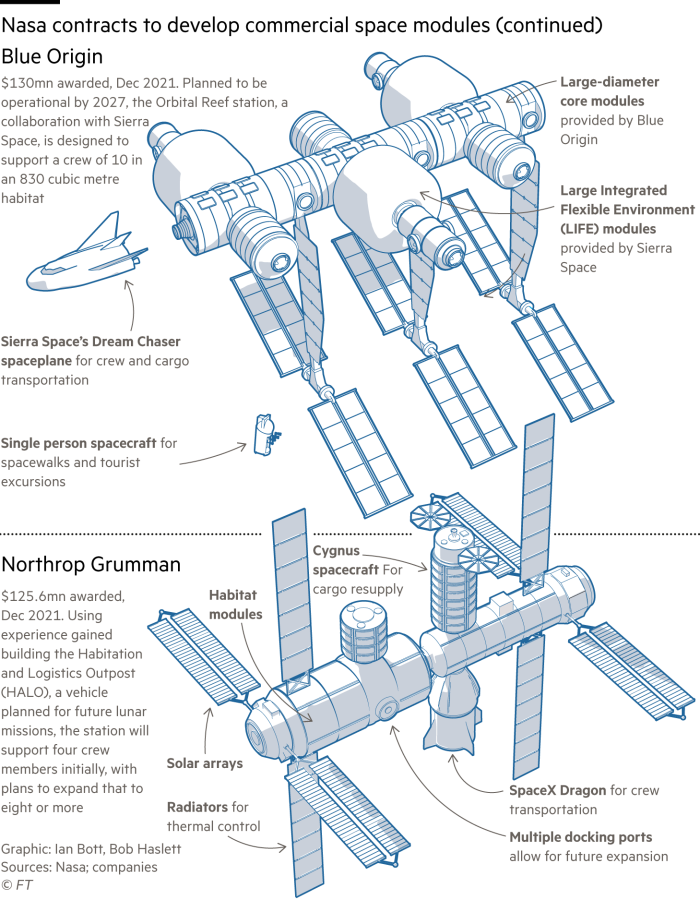

In December 2021, Nasa awarded three more design contracts for free-flying space stations in the second stage of the competition. A consortium led by Nanoracks, the in-space services company owned by Voyager Space, is proposing Starlab, an inflatable science park designed by Lockheed Martin. Blue Origin and Sierra Space are offering the Orbital Reef project, a 30,000 sq ft “ecosystem” of different habitats and services for industry, research and tourism.

Finally Northrop Grumman aims to build a platform that can be used for training or science projects, but it is still seeking an operator. “We are manufacturers,” says Andrei Mitran, Northrop’s strategy director. “We are not committed to put something in orbit that we will own.”

Not all the projects will make the final cut, expected in around 2025 when Nasa will agree firm service agreements with its chosen candidates. Whether the business models are commercially viable will be an important condition. “We are refining our forecast of what we want to buy in the way of services,” says Gatens. “They can take that and mix with non-Nasa customers and come up with their own business plan. We want to be one of many customers.”

Paths to transition

Nasa still worries about whether the commercial market will be big enough to sustain private stations. “Nasa is promoting several space stations because they don’t want all their eggs in one basket,” says the UK National Space Centre’s Patel. “There isn’t necessarily commercial demand now because the industries they hope to cater to, like space manufacturing and tourism, are not mature.”

Investment bank Citi estimates a market for the whole space economy as big as $1tn a year by 2040. But the forecast for annual sales for commercial space stations is estimated at just $8bn, comprised of services such as astronaut training, research and new industrial activities including space logistics and mining.

Others are more pessimistic. A granular study of five potential markets for commercial space stations — ranging from manufacturing to satellite assembly and maintenance; astronaut training for new spacefaring nations; and entertainment and tourism — estimated the market would be between $455mn and $1.2bn in annualised revenues by 2025.

That study, published in 2017 by the Washington DC-based Science and Technology Policy Institute, calculated the costs of operating a station at between $463mn and $2.25bn per year. It concluded that only under the most optimistic cost and revenue scenarios could the stations be commercially viable without…

Read More: The race to reinvent the space station